What if everything you’ve learned about managing business finances was backwards? That’s the bold idea behind the Profit First Model, a system that’s flipping traditional accounting on its head.

Designed with small businesses, freelancers, and startups in mind, this approach is helping entrepreneurs take control of their cash flow and build more sustainable companies.

But how does it actually work—and why are so many business owners swearing by it? Let’s break it down.

What Is the Profit First Model?

The Profit First model is built on a powerful shift in mindset: put profit first, not last. Instead of following traditional accounting, where profit is what’s left after expenses, this method flips the equation.

You allocate a portion of your income to profit immediately, as soon as revenue comes in.

This model creates built-in financial discipline by forcing businesses to operate within what’s left after profit, taxes, and owner pay are accounted for.

It’s become especially popular among small and midsize businesses (SMEs), freelancers, and startups that want a clearer, more sustainable approach to managing money.

Step-by-Step Guide to Implementing the Profit First Model in Your Business

Ready to implement the Profit First model in your business? Follow these actionable steps to get started.

1. Analyze Your Current Financial Situation

Before you make any changes, you need to know exactly where you stand. Think of this as a financial health checkup—it helps you spot leaks, inefficiencies, and untapped opportunities.

Many business owners overlook this step, yet it’s the foundation of every smart money decision that follows. Without this clarity, any allocation you set will be based on guesswork, not strategy.

Take the time to review your current cash flow, income sources, and expenses. This helps you understand where your money is going and lays the groundwork for setting realistic allocation percentages.

2. Set Up Five Core Bank Accounts (Income, Profit, Owner’s Pay, Taxes, Operating Expenses)

The real magic of Profit First starts with separating your money. By giving each dollar a specific job, you create boundaries that force healthier financial decisions. These accounts aren’t just administrative—they’re your guardrails for keeping profit intentional and protected.

Even small businesses or solopreneurs benefit from the structure and accountability this step creates.

Create the following accounts:

- Income Account: The main account where all revenue is deposited before distribution.

- Profit Account: Reserved for the owner’s profit and long-term business rewards.

- Owner’s Pay Account: Ensures the owner receives regular, predictable compensation.

- Tax Account: Set aside specifically to cover income and business taxes.

- Operating Expenses Account: Used for day-to-day business operations and overhead.

3. Establish Initial Allocation Percentages for Each Account

This is where you put your plan into action—dividing your revenue with purpose. Start with realistic percentages based on your current finances, then refine over time. Even small profit allocations are meaningful, as they build the habit of prioritizing sustainability.

The key is to make intentional trade-offs that favor long-term gains over short-term convenience.

For example, you might allocate 5% to your Profit account, 20% to Owner’s Pay, 15% to Taxes, and 60% to Operating Expenses.

For example, you might allocate 5% to your Profit account, 20% to Owner’s Pay, 15% to Taxes, and 60% to Operating Expenses.

4. Schedule Regular Allocation Days (e.g., 10th and 25th of Each Month)

Consistency is what transforms a system into a habit. By committing to set days, you eliminate randomness and emotion from your money decisions. Allocation days become your regular financial checkpoints, keeping you engaged and accountable.

Over time, this rhythm helps smooth out income volatility and creates predictability in your cash flow.

Determine a schedule for transferring funds between accounts, ensuring that the money is allocated consistently.

5. Transfer Funds According to Set Percentages on Allocation Days

This is the moment where planning meets action. You’re no longer reacting to your finances—you’re directing them. Transferring funds as scheduled gives structure to your growth and security to your operations.

It also reduces stress because you’ve already accounted for what matters most. On your allocation days, transfer the designated percentages into each account.

6. Monitor Cash Flow and Adjust Percentages Quarterly

A business that doesn’t adjust is a business that risks stagnation. Quarterly reviews help you course-correct and refine your strategy with data, not guesswork.

It’s not about changing everything—it’s about making smarter decisions with better visibility. Think of it as routine maintenance for a more resilient business.

Every quarter, assess your financial situation and adjust the allocation percentages if necessary to ensure your business remains financially healthy.

7. Maintain Discipline by Spending Only from Operating Expenses

This is where restraint pays off. Sticking to just one account for spending keeps you within healthy limits and stops impulse decisions from sabotaging your goals. It might feel restrictive at first, but it’s actually liberating—you know exactly what you can spend without guilt or risk.

Over time, this constraint becomes a powerful tool for growth and stability. Stick to spending only from your Operating Expenses account, keeping the other funds secure for their intended purpose.

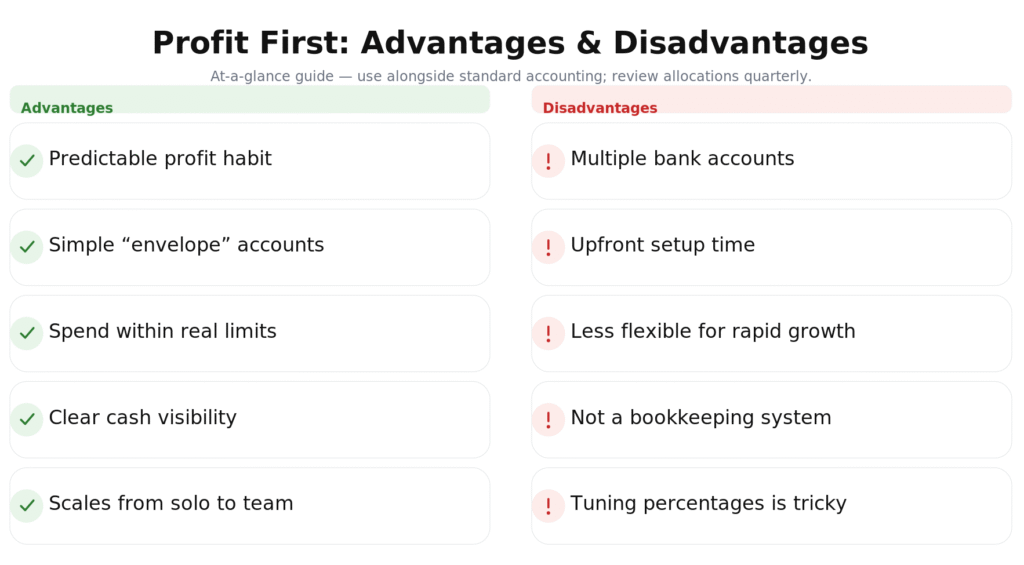

The Advantages and Disadvantages of Using the Profit First Method

The Profit First method offers a structured approach to financial management that prioritizes profit, ensuring businesses pay themselves first. However, like any system, it comes with both advantages and limitations.

Advantages of Profit First

1. Predictable Profit Allocation

Allocating a fixed percentage of revenue to profit ensures that your business prioritizes sustainability from day one. This approach makes profitability a habit instead of a hopeful outcome. It creates a financial buffer that strengthens long-term resilience.

2. Simplified Money Management

The Profit First method makes it easier to manage your business’s finances by assigning specific purposes to separate accounts. This built-in structure creates clarity and reduces the chances of overspending or mismanaging funds.

Tip: HelperX Bot can help with deciding how to categorize and transfer funds across accounts.

3. Better Spending Discipline

Allocating funds in advance forces you to work within real limits. It naturally curbs unnecessary expenses and promotes smarter resource allocation. Businesses become more intentional about what they spend and why.

4. Improved Cash Flow Visibility

With funds clearly divided, it becomes easier to monitor where your money goes. This visibility improves forecasting and helps you make quicker, data-informed decisions. It also reduces surprises during tax season or tight months.

5. Flexible for Any Business Size

The Profit First model can be scaled to fit solo freelancers or growing teams. Percentages and practices can be adapted as revenue increases. Its simplicity makes it accessible without sacrificing impact.

Disadvantages of Profit First

1. Requires Multiple Bank Accounts

While this system requires several bank accounts to function properly, you can easily manage them with the right tools, like Google Workspace, to keep track of all your financial documents and communications in one place.

2. Initial Setup Can Be Time-Consuming

Setting up accounts, calculating allocations, and learning the method takes time. For new users, it may feel like an extra burden during busy periods. That said, the upfront effort pays off in long-term clarity and control.

3. May Limit Growth Flexibility

Fixed allocations can restrict available cash for expansion or investments. Businesses focused on rapid scaling may find the structure too rigid. Strategic planning is needed to balance growth with financial discipline.

4. Not a Complete Accounting Replacement

Profit First is a cash management framework, not a bookkeeping solution. You’ll still need traditional accounting tools for reporting, taxes, and compliance. It’s best used as a complement to, not a substitute for, proper accounting.

5. Percentage Adjustments Can Be Tricky

It can be difficult to know when and how to shift your allocations. Misjudging adjustments might disrupt cash flow or underfund key areas. Regular review and sound financial tracking are necessary to make smart changes.

Is the Profit First System Right for Your Business?

Profit First isn’t a one-size-fits-all solution, but it’s highly effective when used in the right context. Knowing where your business fits can help you decide if this system supports your financial goals.

Businesses That Benefit Most from Profit First

Companies with straightforward cash flow and a need for discipline often thrive with this model. It works especially well for those who want more control, clarity, and sustainable profitability.

- Freelancers with irregular income who need consistent pay and budgeting structure

- Small and midsize businesses focusing on cash flow over aggressive scaling

- Service-based businesses managing multiple recurring and variable expenses

- Entrepreneurs looking for a simple way to track and grow profitability

- Sole proprietors who want to pay themselves reliably and reduce financial stress

Businesses That May Struggle with Profit First

Larger or high-growth businesses with complex structures may find the model restrictive. The system favors lean operations and stability over rapid, high-risk expansion.

- Large corporations with layered accounting and multi-department budgets

- Venture-backed startups aiming for fast scaling and reinvestment

- Businesses with high capital expenditure requirements or fluctuating inventory needs

- Companies in hyper-growth stages needing flexible cash reinvestment strategies

- Firms with complex international tax and finance obligations

Final Take: Profit First Is a Practical System for Smarter Money Management

The Profit First model gives business owners a straightforward way to build profit into every financial decision. Instead of hoping there’s money left over, you intentionally secure profit upfront and run your business with what remains.

This shift in flow creates accountability, reduces stress, and lays the groundwork for long-term financial stability.

What makes Profit First truly effective isn’t just the accounts or percentages—it’s the mindset behind it. You’re committing to discipline, patience, and a new definition of success that’s rooted in sustainability over short-term gains.

When followed consistently, this system helps you break unhealthy money habits and develop smarter, more confident decision-making as a business owner.

Frequently Asked Questions

The Profit First method is a cash management system that prioritizes profit by allocating revenue into separate accounts for profit, owner’s pay, taxes, and operating expenses. This ensures your business stays profitable by managing cash flow efficiently.

To implement Profit First, set up five core bank accounts, allocate your revenue into those accounts on a set schedule, and adjust your percentages quarterly to ensure profitability and discipline in managing your business’s finances.

While Profit First works well for small to midsize businesses, large corporations with complex accounting systems may find it challenging to implement. The system is best suited for companies with simpler financial structures and a focus on cash flow management.

Sources:

- https://medium.com/@gg4ct8cr0/profit-first-mike-michalowicz-book-review-17a8bd34c3d4

- https://medium.com/@syukri.shamsuddin/the-revolutionary-financial-system-every-business-owner-needs-4948197e7e9a

We empower people to succeed through practical business information and essential services. If you’re looking for help with SEO, copywriting, or getting your online presence set up properly, you’re in the right place. If this piece helped, feel free to share it with someone who’d get value from it. Do you need help with something? Contact Us

Want a heads-up once a week whenever a new article drops?