Choosing where to invest (search or social) shapes how fast you grow and who you attract. After all, digital now accounts for around 75% of global ad spend, and ad revenue in 2025 is expected to hit $979 billion.

Search shines when people already want what you offer. Social wins when you need to spark demand, build affinity, and stay top-of-mind. This guide breaks down when to lean into each channel so your budget does the most work.

(Keep reading to the end because this is full of game-changer insights you don’t want to miss!)

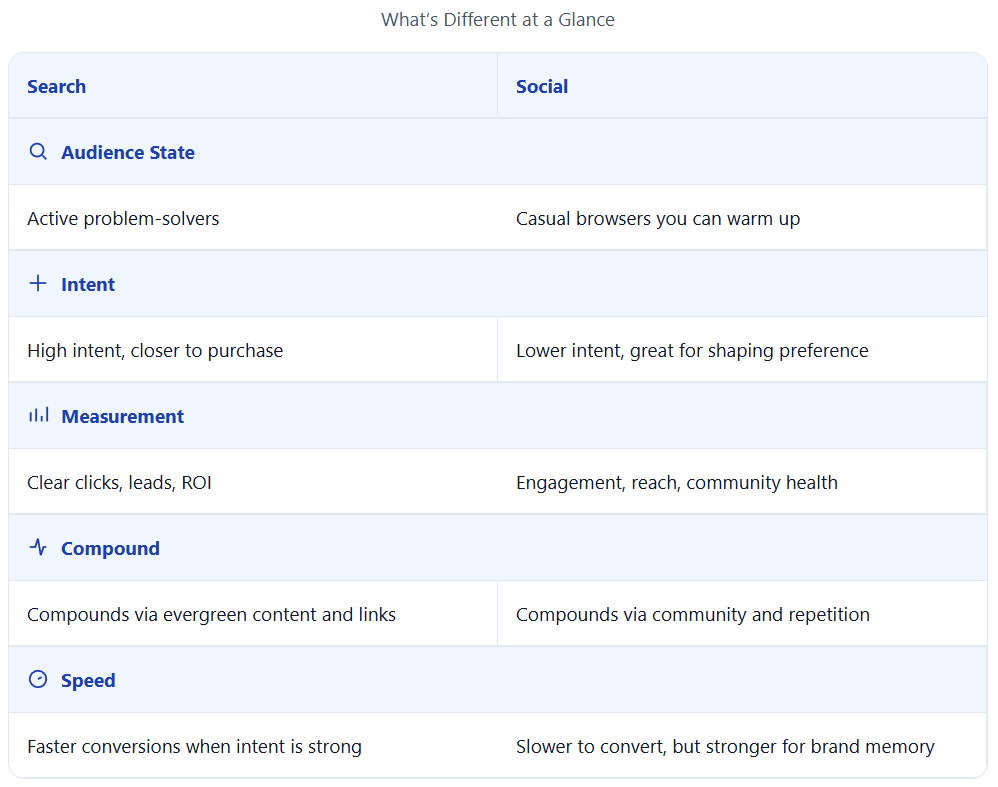

Search vs. Social (Quick Snapshot):

Target Audience

Search marketing reaches people actively looking for answers or vendors. They type the need; you meet it. Because the intent is explicit, you can route them to pages that solve the exact problem and convert quickly. In other words, search captures existing demand.

In contrast, social media marketing reaches a wider, earlier-stage audience. They’re not always “shopping,” but they’re open to ideas. This is where you earn attention, introduce your brand, and nurture demand long before the Google search happens. Put simply, social creates and warms future demand.

Today, more than 5.20 billion users use social platforms worldwide, which is about 64% of the global population. On average, each internet user now spends about 2 hours 21 minutes per day on social media.

User Intent

Search traffic carries clearer intent, such as “find X,” “compare Y,” or “hire Z.” That clarity raises conversion rates when your page matches the query and offers a clean next step (e.g., demo, quote, add to cart). Search wins in the moment of need.

Consider the current Google Ads benchmarks across all industries:

- Average click-through rate (CTR) sits at 6.66%

- Cost-per-click (CPC) averages $5.26

- Conversion rate (CVR) comes in at 7.52%

- Cost-per-lead (CPL) hovers around $70.11

Social traffic is more exploratory. People scroll for stories, entertainment, and connection. Conversions still happen, but more often after repeated touchpoints, such as content that educates, entertains, or provides social proof. Social wins the moments leading up to conversions.

Cost Efficiency and Budget Control

Search is predictable when you match queries to high-intent pages. You can see the CPC, set caps, and pause keywords that don’t pay back with search ads.

Plus, with strong Quality Scores and relevant landing pages, your effective cost per lead tends to decrease over time. As for organic search, results compound once a page ranks. Each additional visitor becomes cheaper.

In contrast, social can be cheaper per click, but pricier per customer. This is because most social clicks are early-stage. You’ll spend on creative, testing, and retargeting to move people from “cool post” to “let’s buy.” However, it works (especially for new products or brands with low search demand), but you need to budget for the longer path.

Search and retail media ads are on track to hit $357 billion this year (up 8%). Social media ad spending is expected to grow even faster, climbing 11% to $242 billion. Meanwhile, short-form video ads continue their steady rise, projected to reach $80 billion (a 7% increase year over year).

Analytics and What to Measure

Search gives clean lines from query to page to conversion. You can tie revenue to keywords, landing pages, and positions. That clarity makes it easier to prune waste and double down on winners. Search offers close-range attribution.

Social needs a wider lens. Track assisted conversions, branded search lift, and time-series trends (e.g., direct traffic during campaigns). Engagement metrics like saves, replies, and shares are not vanity metrics if they predict later demand.

Be sure to create simple guardrails like a baseline CAC target, a branded search KPI, and one primary action per campaign. Social needs near-term signals plus medium-term brand lift.

Long-term Impact and Compounding

Search compounds through assets, such as evergreen guides, comparison pages, and link-worthy resources. Each new link and internal update strengthens the whole site. The flywheel is slow at first, but then it becomes durable.

Social compounds through memory with factors like repetition, distinctive creativity, and community. Show up with a recognizable voice and consistent POV. Reuse high-performing posts, turn comments into content, and move fans to owned channels (email, SMS, etc.) so touchpoints keep stacking.

Social media plants the idea; search marketing harvests it.

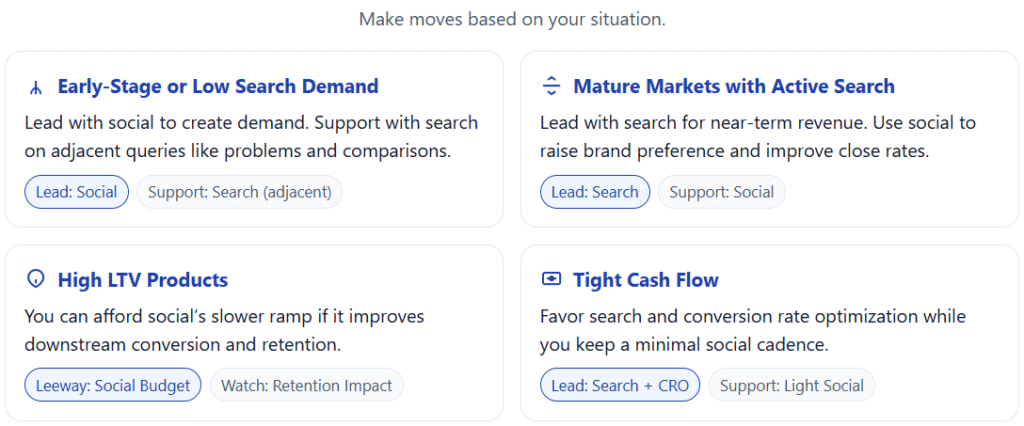

Channel Economics (CAC, LTV, and Stage Fit):

Sample Budget Splits

| Stage | Possible Mix |

| Launch / low search demand | 70% social (creative, testing, retargeting), 30% search (brand + adjacent problems) |

| Grow / active search present | 60% search (SEO + PPC), 40% social (awareness + proof) |

| Scale / tight CAC target | 75% search, 25% social (maintain pulse, focus on retargeting + UGC/user-generated content) |

You can adjust your mix each month in a few solid ways. Start with cost, then look at brand momentum, and reinforce what is already winning in search.

If CAC on Social Stays High

Did CAC on social sit above your target for two straight months? If yes, shift about 10% of the budget from social to search. Search captures people who are already looking, so it often lowers your cost per customer while you improve social creative and the call to action.

Keep posting on social, but tighten your message and make the next step obvious. For example: “Start free trial. No credit card.”

When Brand Momentum is Rising

If branded searches in Google are climbing and your close rates are improving, add roughly 10% more to social for the next month. That lift is a signal that your content is shaping demand and that more visitors now arrive with brand familiarity.

Remember, you are investing in future intent that shows up as more people searching your name and saying “yes” faster.

When a Search Page Breaks Into the Top Three

If a page ranks in the top three and drives strong clicks, leave the core content alone. Treat it like a winning asset. Even small edits can change intent match or snippet behavior.

Reinforce it without editing the page. For example, create supporting pages that answer adjacent questions or comparisons people also search for, then link to the ranking page with clear, relevant anchors. Supporting pieces widen your entry points from search and strengthen internal relevance to the hero page.

Consider this: Zero-click searches are rising. Similarweb and SparkToro analyses show U.S. “no-click” rates climbed year over year. And AI Overviews appear much more often in search. This shifting organic CTR shows why protecting “winners” matters.

But even so, some winning page changes will be unavoidable. However, avoid big rewrites, headline changes, or URL moves if possible. Never bloat a winning page. Focus on capturing related queries on their own pages and funnel interested users to the asset that already ranks.

Offers That Convert in Each Channel

Search-Native Offers

These work when intent is high and people want a clear next step. Some examples include:

- Instant quote or pricing calculator.

- Comparison checklist or buyer’s guide.

- Talk to a specialist or book a demo.

- Free trial with no credit card.

Searchers already have the problem in mind. Give them clarity, proof, and a fast path to action.

Social-Native Offers

These warm demand and pull people toward your brand. Examples include:

- Teardown threads or mini demos.

- Before/after stories or creator-led walkthroughs.

- Community invites, workshops, or live Q&A.

- Limited-time bundles or starter kits.

Scrollers are exploring. Show outcomes, reduce uncertainty, and invite a lightweight step. Retarget engagers with the same core promise they’ll see on your landing page.

Common Mistakes to Avoid with Both Channels

Here are some “do nots” for best results.

1. Treating Channels Like Silos

Running social without a matching landing page, or ranking a page without ever talking about it on social, leaks demand. Pair every social hit with a related search asset, and reference your ranking pages on social so people can go deeper.

2. Measuring Social Like Search

Expecting last-click ROI from social in week one leads to cuts that stall momentum. Use a wider lens. Track assisted conversions, branded search lift, list growth, and time-series trends. Keep CAC in view, but judge social on near-term signals that predict demand later.

3. Buying Clicks You Can’t Convert

High-intent search traffic won’t rescue a weak offer or a confusing page. So fix the page before you scale spend, such as tightening the headline, adding proof near the top, answering FAQs, and giving one clear CTA.

4. Over-Segmenting Early

Ten tiny audiences with tiny budgets produce weak learning. Start broad to see what actually resonates, then narrow once you have real data. Depth comes from insight, not from cutting too soon.

5. Inconsistent Promises

Noted earlier, but worth repeating. If your post promises “Set up in minutes,” your landing page cannot say “Book a discovery call.” Keep the promise, proof, and CTA consistent from post to page to checkout. Consistency reduces friction and builds trust.

6. Ignoring Compounding

Search compounds mainly through content publishing, refreshes, and links. Social compounds through repetition and a recognizable voice. Random one-offs do not stack. So reuse what works, connect pieces with internal links, and move fans to owned channels so touchpoints add up.

Build a System That Uses Both

It isn’t Search vs. Social. Winning brands use both, so demand is created, captured, and reinforced. When your promise is clear and every touchpoint points to the same next step, results stack over time. Think One Promise, Two Doors. Your promise sits at the center. Social is the warming door. You use stories, proof, and repetition to make people care.

Search is the capturing door. You meet intent with pages that repeat the same promise and remove friction. Both doors open to the same action, which is how you reduce leaks and lift conversion without shouting.

One promise, two doors, one path to action. Do that with discipline for a quarter and you might see compounding, not just spikes.

FAQ

Typical paid search tests run 4–6 weeks with a few hundred clicks ($1–3K in many markets). SEO shows early signals in 30–60 days and steadier lift after ~90 days. Paid social creative tests usually run 2–4 weeks with several thousand impressions per ad and ~$1–3K/month in lean tests.

Typically, Google wins first for local intent. People who search “near me” often visit or buy soon after, and many clicks go to Google’s map results. So search and map visibility (plus Local Services Ads for eligible categories) usually produce earlier leads or foot traffic. Social tends to add lift through awareness and offers rather than immediate, high-intent visits. That said, younger audiences rely more on social for local discovery, so the ideal mix can vary by customer base.

Yes, though the mix has shifted. Google’s AI Overviews now reach well over a billion people monthly, and studies show a year-over-year drop in organic clicks alongside a rise in zero-click results. That doesn’t kill SEO; it changes where wins show up. Brands still benefit from ranking on high-intent queries, owning map and product surfaces, and being referenced inside AI Overviews. In short, search remains a massive demand capture channel.

Sources:

- https://www.marketingdive.com/news/magna-latest-to-downgrade-global-ad-spending-forecast-expects-979b/750871/

- https://wearesocial.com/wp-content/uploads/2025/02/GDR-2025-v2.pdf

- https://www.wordstream.com/blog/2025-google-ads-benchmarks

- https://searchengineland.com/zero-click-searches-up-organic-clicks-down-456660

Gabriel Nwatarali is a copywriter, SEO expert, and the founder of Tech Help Canada. He helps founders attract the right kind of search traffic through SEO strategy, content that ranks, and conversion-focused copy. In one project, a single copy tweak helped a brand increase downloads from a few hundred to 10M+. Want a second set of eyes on your site? Reach Out Here

Want a heads-up once a week whenever a new article drops?